Whether you’re earning a six-figure salary or just out of college, creating and maintaining a budget is a must. Having a budget that you actually use can help

Buying a house is one of the biggest, if not the biggest purchase you’ll make in your lifetime. Here are some tips and tricks for ensuring that the entire

*This content is developed from sources believed to be providing accurate information. The information provided is not written or intended as tax or legal

Retirement can sneak up on you.

At one time, it seemed like a lifetime away, now it may be just around the corner. At one time you planned on working forever

It’s certainly no secret that healthcare costs have escalated in recent years, and there’s no reason to believe that the end is in sight. But whether you have

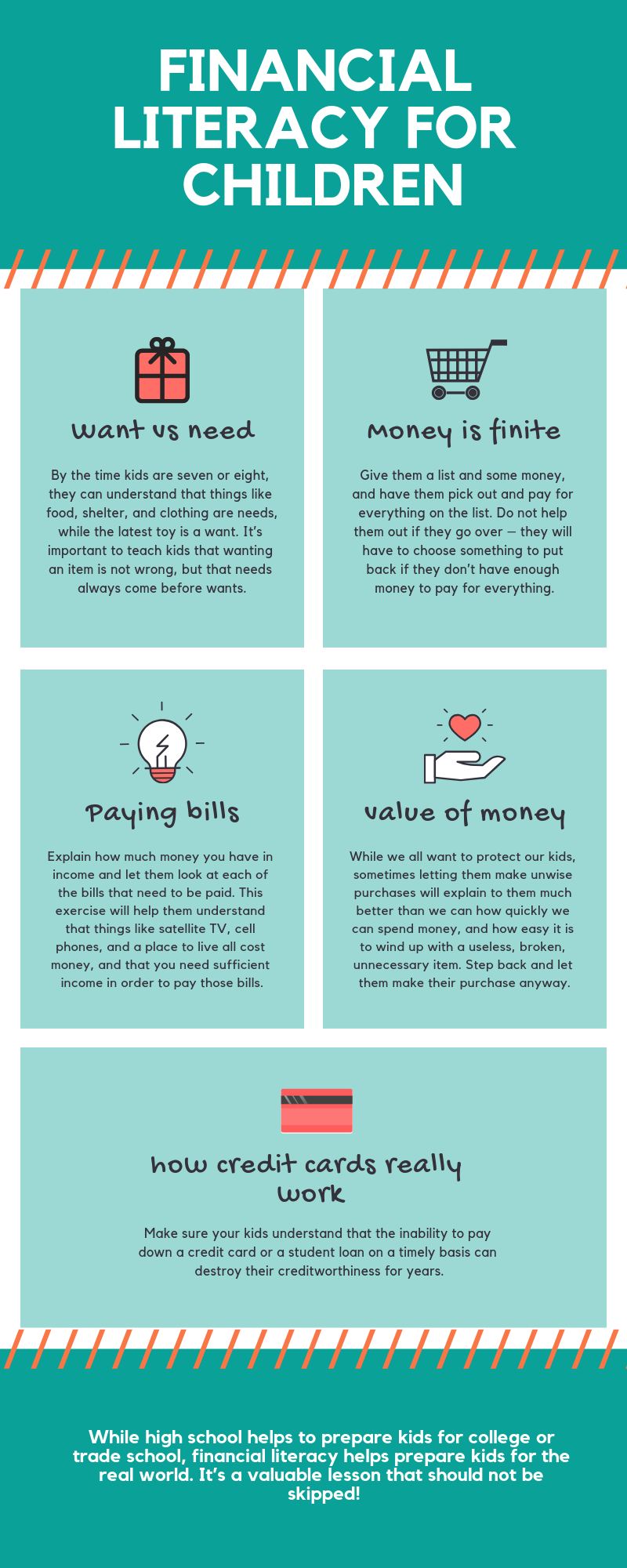

If you’ve spent more than five minutes on a kid’s television network, you’ve seen just how inundated young kids are with commercials for everything from the

Has a dog or cat grabbed hold of your heart? It doesn’t take much. A paw on the arm. A lick on the nose, or a soft purr or whimper can turn most of us into dog

There’s nothing more exciting than buying your first home. Whether it’s a condo for one, a sprawling mansion, or anything in between, buying your first home

*This content is developed from sources believed to be providing accurate information. The information provided is not written or intended as tax or legal

Have you ever wondered exactly what those initials after a financial professional’s name mean? You’re definitely not alone. The easy way to tell is to visit

While it may not seem so, there are a lot of painless ways to save money. Not just for those who have a limited cash flow, but also for those with plenty of